BIS Innovation Hub

Mandate and Swiss Centre

The BIS Innovation Hub was set up in 2019 and maintains seven centres: Switzerland, Hong Kong, Singapore, London, Nordic (Stockholm), Eurosystem (Paris and Frankfurt) and Toronto. In addition, a strategic partnership was established with the Federal Reserve Bank of New York. The Innovation Hub's objective is to gain in-depth insight into technological developments of relevance to central banking. It also aims to develop public goods in the technology space geared towards further improving the functioning of the global financial system. Employees of the BIS and the SNB work on various projects at the BIS Innovation Hub Swiss Centre in Basel and Zurich. A selection of current and concluded projects follows. Projects at the BIS Innovation Hub Swiss Centre are exploratory in nature.

Projects at the Swiss Centre

-

The first two phases of Project Helvetia were carried out in a collaboration between the SNB, the BIS and SIX Group Ltd, which operates Switzerland’s financial market infrastructure. Phase II also involved participation by five commercial banks. Project Helvetia then proceeded to the pilot phase without the participation of the BIS.

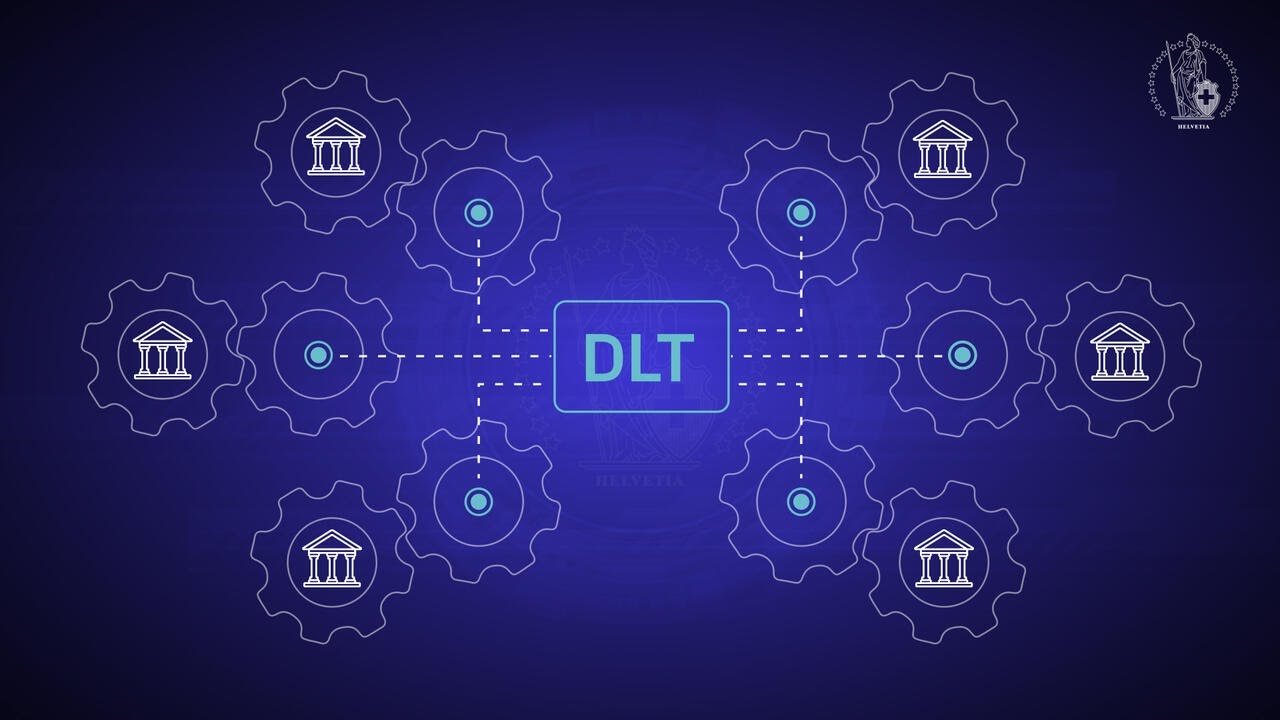

Phase I focused on providing central bank money for financial institutions (wholesale central bank digital currency, or wholesale CBDC) on a DLT-based financial market infrastructure for the custody and transfer of digital (token-based) securities. The process used the test system of SDX (SIX Digital Exchange), the regulated platform for digital securities operated by SIX. Two specific approaches to the settlement of digital securities with central bank money were studied, and both proved technically and legally feasible.

Integrated settlement of transactions was tested with the issuance of wholesale CBDC on SDX. The RTGS link (an interface between SDX and the Swiss Interbank Clearing payment system, or SIC) was deployed to test synchronised settlement. Here, the RTGS link used existing functionalities of the SIC system.

Phase II tested the integration of wholesale CBDC into existing core banking systems as well as commercial bank and central bank processes.

As part of the ongoing Helvetia pilot, the SNB is issuing wholesale CBDC for the settlement of various financial transactions on the SDX platform.

Required category: Third-party

Please accept the relevant category to view this content.

Required category: Third-party

Please accept the relevant category to view this content.

-

Project Jura evaluated the settlement of Swiss franc and euro foreign exchange (FX) transactions with wholesale CBDCs as well as the issuance, transfer and redemption of a euro-denominated tokenised security, including its cross-border settlement.

The experiment studied the direct transfer, between French and Swiss commercial banks, of wholesale CBDCs in Swiss francs and euros on a single DLT-based platform operated by a third party. This involved using a modified SIX Digital Exchange test system. The tokenised asset and FX transactions were settled safely and efficiently using delivery-versus-payment or payment-versus-payment mechanisms. The experiment was conducted in a near‑real setting, used real‑value transactions, and met current regulatory requirements.

Issuing several wholesale CBDCs on a third‑party platform and giving regulated, non‑resident financial institutions direct access to central bank money raises intricate central bank policy issues. The project explored a new approach, including subnetworks on DLT platforms and a process known as 'dual‑notary signing', which offers central banks a mechanism for maintaining requisite control over the issuance of, and access to, wholesale CBDC on third-party platforms. Project Jura was conducted by the Banque de France, the BIS Innovation Hub and the SNB in collaboration with a group of private sector firms.

Required category: Third-party

Please accept the relevant category to view this content.

-

Project Mariana studied the cross-border trading and settlement of spot FX transactions in Swiss franc, euro and Singapore dollar wholesale CBDCs between simulated financial institutions on the basis of new technological concepts from decentralised finance (DeFi).

The feasibility study involved: (i) a common technical token standard for a public blockchain to facilitate exchange and interoperability between various currencies; (ii) bridges for seamless wholesale CBDC transfers between various networks; and (iii) an automated market maker (AMM), which is a specific type of decentralised exchange for the automatic trading and settlement of spot FX transactions.

The study was undertaken by the SNB in collaboration with the Banque de France, the Monetary Authority of Singapore, and three BIS Innovation Hub Centres (Swiss, Eurosystem and Singapore).

Required category: Third-party

Please accept the relevant category to view this content.

-

Project Rio developed a prototype for a data platform and a dashboard to monitor fast-paced markets. In recent years, new technologies have sharply accelerated the pace of trading, particularly in FX markets. Trading is also increasingly fragmented and takes place on many platforms in parallel. The prototype developed at the BIS Innovation Hub Swiss Centre made it possible to process in real time the high-frequency market movements and large volumes of data being generated in various trading centres, and to derive indicators on trading conditions from these data. The prototype was successfully tested and applied in a pilot phase involving seven central banks around the world. Project Rio findings are currently helping the SNB analyse trading conditions in the FX markets.

Required category: Third-party

Please accept the relevant category to view this content.

-

Project Tourbillon developed two prototype retail CBDC platforms to provide cash-like payer anonymity. There is a demonstrated public need for anonymous payments. The concept of payer anonymity offers cash-like anonymity to consumers, but not to the recipients of payments. In these prototypes, a consumer can pay a merchant in retail CBDC without revealing personal data to anyone: neither the merchant, nor the banks, nor the central bank. However, the merchant's identity is disclosed to the merchant's bank (as part of the payment), which treats it confidentially, in line with standard procedure. This concept helps reduce tax evasion or illicit payments. While the central bank can see the transaction amount in order to prevent double spending, it remains unaware of any details regarding the consumer or the merchant.

In addition, one of the prototypes increased security in the event of attacks by quantum computers by implementing quantum-safe blind signatures. It could be shown that, while the approach is possible, it would significantly reduce transaction volume compared to the other approach, which uses conventional cryptography, and that it would also entail additional research and development costs.

Required category: Third-party

Please accept the relevant category to view this content.

-

Project Promissa studies the tokenisation of financial instruments known as promissory notes, which are used by multilateral development banks for financing, among other things. Tokenisation is intended to facilitate the custody and management of these still paper-based instruments, and thus to reduce costs and sources of error. The project is a collaboration between the BIS Innovation Hub, the World Bank and the SNB.

-

Project Neo seeks to support central banks in their monetary policy decision-making by capturing data from novel sources and analysing these data using innovative methods such as artificial intelligence (AI). Statistical surveys are often available only with a considerable time lag. To address this, the project aims, for example, to measure economic activity with the help of data on passenger and cargo transport, air pollution, electricity consumption, retail trade and payment transactions, and to do so in a timely and granular fashion.

-

In Project Agorá, the BIS, together with seven central banks (Banque de France, representing the Eurosystem; Bank of Japan; Bank of Korea; Banco de México; the SNB; Bank of England; and the Federal Reserve Bank of New York), is exploring how tokenised customer deposits at commercial banks can be seamlessly integrated with wholesale CBDC in a public-private programmable core financial platform, with an eye to overcoming inefficiencies in cross-border payments.